Are 650 a good credit score?

Certain lenders like not to give in order to borrowers with credit ratings regarding Fair assortment. Thus, the resource choices are going to be a bit minimal. That have a rating off 650, the desire are going to be to your building your credit report and increasing their credit ratings before applying when it comes down to loans.

Among the best an effective way to create credit is by becoming extra because the a third party affiliate by someone who already possess high credit. That have individuals inside your life that have a good credit score which can cosign to you is additionally an option, nonetheless it can also be hurt its credit rating for many who miss money otherwise default on the loan.

Do you really score a charge card with a 650 credit rating?

Bank card individuals with a credit score contained in this range may have to establish a safety put. Trying to get a guaranteed bank card is probably the best option. Although not, creditors often need a protection deposit out-of $five hundred $step 1,100. It’s also possible to be capable of geting a starter bank card out-of a cards relationship. Its an unsecured bank card, it has the lowest credit limit and you can high attract speed.

When you’re able to find recognized having credit cards, you must make your own monthly premiums timely and keep your own balance less than 31% of one’s borrowing limit.

Do you really get a consumer loan which have a credit score of 650?

Very few consumer loan lenders often agree your getting an individual loan having a beneficial 650 credit history. However, there are that actually work with poor credit individuals. But, signature loans from these lenders feature higher rates.

It’s best to stop cash advance and higher-notice unsecured loans because they carry out long-name personal debt issues and simply join a further decrease in credit history.

To construct borrowing from the bank, applying for a card creator financing can be advisable. Instead of providing the cash, the cash is largely placed in a family savings. When you pay back the borrowed funds, you have access to the money and additionally one focus accumulated.

Ought i score home financing which have https://speedycashloan.net/loans/20000-dollar-payday-loan/ a credit score out-of 650?

Although not, for these wanting applying for a keen FHA financing, people are merely necessary to possess at least FICO get of five hundred to help you qualify for a downpayment around ten%. People who have a credit rating out of 580 can also be be eligible for an excellent advance payment as low as step three.5%.

Can i get a car loan with a great 650 credit rating?

Certain car lenders will not provide to some body having a great 650 rating. If you find yourself able to find recognized to own an auto loan which have an excellent 650 rating, it could be expensive. If you possibly could improve your credit score, bringing a car or truck is simpler.

How to Increase good 650 Credit score

Credit scores throughout the Fair assortment usually reflect a reputation credit errors otherwise problems. Such as for instance, you really have some late payments, charge offs, foreclosure, and even bankruptcies appearing in your credit file.

1. Disagreement Negative Accounts in your Credit report

It’s best to grab a duplicate of the totally free credit file off each of the around three significant credit reporting agencies, Equifax, Experian, and you will TransUnion to see what’s getting stated about yourself. If you discover people bad items, you’ll be able to get a credit fix business including Lexington Law. Capable make it easier to dispute them and perhaps have them eliminated.

Lexington Legislation focuses primarily on deleting bad activities from the credit history. They have over 18 many years of sense and have removed more than 7 million bad products because of their readers into the 2020 alone.

- hard questions

- late repayments

- choices

- costs offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

dos. Remove a credit Creator Mortgage

Borrowing from the bank builder financing try cost loans that will be created specifically in order to assist people with poor credit make or reconstruct credit rating. In fact, borrowing from the bank builder financing none of them a credit score assessment whatsoever. Also, it’s probably the most affordable and you will proper way to increase the borrowing from the bank score.

That have borrowing from the bank creator fund, the cash consist when you look at the a checking account up to you complete most of the your own monthly premiums. The loan money are reported to just one credit agency, which provides your credit scores a boost.

step three. Rating a guaranteed Charge card

As the mention before, delivering a secured bank card is a wonderful way to establish borrowing. Secured credit cards performs much the same because unsecured credit cards. The sole distinction is that they wanted a security deposit that also will act as your own borrowing limit. The financing card issuer could keep your own put for those who avoid making the minimal commission otherwise cannot pay their charge card balance.

cuatro. Getting a third party Representative

Whenever you are next to anyone who has sophisticated borrowing, to-be an authorized representative on the borrowing from the bank account, is the quickest way to improve fico scores. Its account information will get placed into your credit report, that can improve credit scores instantly.

5. Create Credit if you are paying Your own Rent

Unfortuitously, lease and you will electric costs aren’t constantly said for the credit agencies. Although not, to have a small fee, lease revealing services could add your payments towards credit history, which will help your alter your credit scores.

Where to go from here

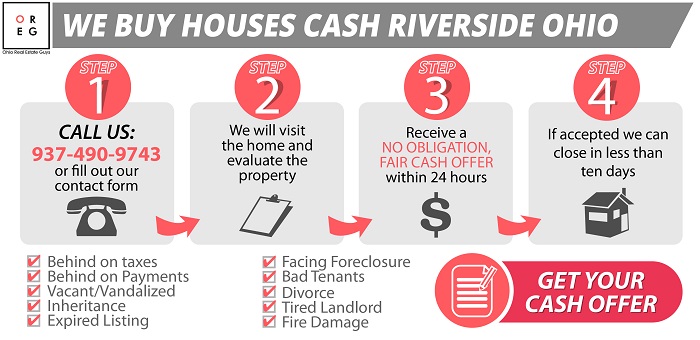

It is very important understand and that products compensate your credit score. As you can tell on the picture lower than, there are 5 situations that make up your credit score.

Lower their balance and keep your own borrowing from the bank use significantly less than 30%. It’s adviseable to keeps different types of borrowing from the bank profile in order to establish a stronger borrowing from the bank combine as it makes up about up to 10% of your FICO score. So, you will need to enjoys each other cost and you may revolving borrowing from the bank popping up in your credit file.

Needless to say, in addition have to manage while making prompt money from here to your aside. Also you to definitely later fee can be hugely bad for your borrowing.

Length of credit rating also takes on an important character in your credit scores. We wish to inform you possible financial institutions which you have an extended, positive payment background.

Building good credit cannot happen right-away, you could without a doubt speed up the process by making this new best actions. So give Lexington Law a call for a no cost borrowing from the bank session from the (800) 220-0084 and get come fixing your own borrowing today! The earlier you start, the earlier you will end up on your journey to having a good credit score.