With its extensive experience and a strong presence in the US, Accenture offers valuable support to businesses seeking to optimize their accounts payable processes. They provide a range of services, such as invoice receipt and processing, vendor management, and payment processing, ensuring timely and accurate payments https://www.simple-accounting.org/guiding-cost-principles/ for their clients. When considering accounts payable outsourcing, it’s essential to understand the services provided by accounts payable outsourcing companies. They offer a range of technology, personnel, and value-added consulting services to help manage your accounts payable processes more efficiently.

How To Streamline Your Accounts Payable Process for Better Cash Flow

For example, imagine a business gets a $500 invoice for office supplies. When the AP department receives the invoice, it records a $500 credit in accounts payable and a $500 debit to office supply expense. Communication – Every reputable outsourced AP vendor will have some sort of live customer support, but how they communicate with you will be on their terms. There’s unlikely to be a lot of deep insights that may help your business run better, smoother, and more efficiently from a financial perspective the same way a rockstar AP department would. It’s also worthwhile to take note of their office/staff locations as outsourced AP services can be hosted overseas, which can be a communication barrier. Increased resources – Outsourced AP solutions are generally going to come equipped with technology (i.e. AP Automation platforms) to handle their workflows.

Discover More Business-Specific Accounting and Bookkeeping Services

The time has come to choose your knight in shining armor, your partner in crime, your https://www.wave-accounting.net/ provider. Get ready for a laugh-out-loud adventure through the murky waters of provider selection. Marvel at the transparency and control that come with outsourcing your AP tasks. Witness the hilarity of being in complete control while still being able to enjoy the finer things in life. Some people mistakenly believe that accounts payable refer to the routine expenses of a company’s core operations, however, that is an incorrect interpretation of the term.

Data privacy and security

That is, if the pricing for outsourced bookkeeping and accounting services is cost-effective. Technology can take it a step further with accounts payable software that automatically screens for duplicates the second the invoices are scanned, and before data capture. If your company handles at least 250 invoices per month, you’re looking at spending over $5,000 to process your payables. Suppliers want their payments on time, so they can pay their own invoices. Late payments and lack of communication mean your account payable needs an overhaul.

Tips for managing the accounts payable process from QuickBooks ProAdvisor, Esther Friedberg Karp

How a payable outsourcing service communicates is typically on their terms. Although live customer support is ideal, it may not always be in the price range. Staff can also be located overseas and in a completely different time zone; which puts a strain on communication. Sharing financial information with a third party involves inherent risks in data security and privacy, requiring trust and strong safeguards from the provider.

- With FinancePal, you’ll have a dedicated team of financial experts who are available to assist you whenever you have questions or concerns.

- It’s essential to prepare your in-house employees before outsourcing your accounts payable tasks.

- As you’re not physically present where the tasks are performed, it can be difficult to manage any issues that pop-up.

- By leveraging the skilled workforce available in the LatAm region, businesses can access top-quality accounts payable professionals at a fraction of the cost of hiring in-house staff.

Are accounts payable debits or credits?

These providers stay at the forefront of industry best practices, offering insights and strategies that might be beyond the scope of an in-house team. This level of expertise ensures that AP processes are handled with the utmost professionalism and up-to-date knowledge, safeguarding businesses against compliance risks and inefficiencies. An example of an accounts payable is when a company owes money to vendors for goods or services, such as transportation costs, raw materials, leasing fees, and software subscriptions. Accounts payable show the balance that has not been paid for transactions yet.

These technologies not only streamline the AP process but also provide greater visibility and control. Inquire about their data security measures and compliance with regulations like GDPR or HIPAA, if applicable. Outsourcing accounts payable offers unparalleled scalability, allowing businesses to adjust their AP operations in alignment with their growth trajectory and seasonal demands. This flexibility negates the need for internal staffing adjustments, which can be both time-consuming and costly. Outsourcing accounts payable tasks enables businesses to realign their focus towards the heart of their operations – key areas like product development, customer service, and strategic planning.

We calculate it by dividing total supplier purchases by average accounts payable. Paying bills later (with the amount recorded as accounts what is work in process inventory and how payable) can increase cash flow. On the flip side, delays in receiving payments (recorded as accounts receivable) lower cash flow.

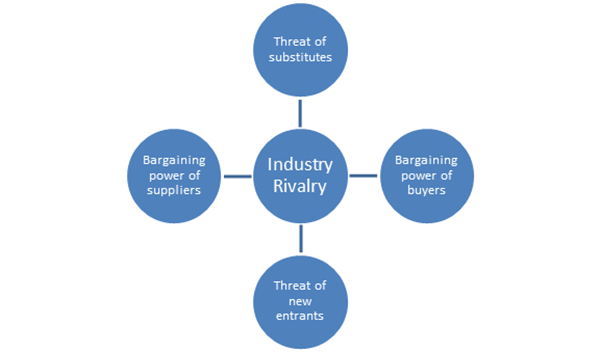

If managing AP internally is proving to be cumbersome, error-prone, or too costly, outsourcing could offer a much-needed solution. Reliance on an external company for crucial financial operations can be risky, especially if the provider faces downtime, service issues, or discontinues operations. Outsourcing can lead to reduced control over the AP processes, which might concern some businesses, especially regarding sensitive financial data.

By outsourcing the tasks above, your organization can focus on more strategic activities and let the outsourcing provider handle the time-consuming and tedious aspects of AP functions. Know how Invensis provides accurate accounting & bookkeeping services for a restaurant which helps effective cost monitoring and growth. We are extremely pleased with the exceptional hospital billing services provided by Invensis. Their expertise and attention to detail in Medicare billing and compliance in medical billing have streamlined our revenue cycle and improved financial performance. SOX Compliance mandates strict reforms to improve financial disclosures from corporations and prevent accounting fraud. We support issues such as auditor independence, corporate governance, internal control assessment, and enhanced financial disclosure based on your SOX Compliance Protocols.

A separate and outsourced AP department does not guarantee transparency when it comes to reporting on these problems. When a company uses accounts payable outsourcing solutions, it pays for the services of experienced professionals who don’t need internal training. A growing company may require more in-house accounts payable department personnel to manage its increasing needs for processing accounts payable functions. AP solutions are not just for big businesses with a high volume of payments. Whether you outsource to a third-party provider or purchase AP automation software, the cost savings are there.

By doing so, businesses leverage the expertise, advanced technological tools, and refined processes of these specialized firms. This not only streamlines the cumbersome and often resource-intensive task of managing payables but also infuses a level of proficiency and precision that might be challenging to achieve in-house. Accounts payable and accounts receivable are key to understanding the financial standing of your business.

Additionally, upgrading those old accounting systems to modern solutions such as Quickbooks can be costly and time-consuming. The proliferation of BPO services has made outsourcing accounts payable to India and other countries a standard business practice. Using outsourcing firms for automated AP tasks may increase the profitability of your business and lower costs.