Having somebody outside of your company who is managing bookkeeping and financial records can take a huge chunk of time off your plate. They can deal with legal compliance, employee wages, paying suppliers, managing expenses, and everything else, so you can focus on other aspects of running a company. External accounting companies will have the most updated knowledge of security procedures and data protection standards. This knowledge is especially important in the current age, with most services and transactions occurring online. An accounting company will have access to the best cybersecurity technology, ensuring you avoid data theft.

Finding the Right Outsourced Bookkeeping Service

Set up check-ins with your provider every once in a while to discuss the partnership and convey expectations. You should also specify what happens if the provider fails to meet any of these expectations. This could be anything from a partial refund for a late delivery, to termination of the contract in more extreme cases.

Outsourced accounting: benefits, types, and getting started

Their job also includes preparing simple financial reports and making sure the bank records match the company’s records. Bookkeepers often take care of payroll, accounting: making sense of debits and credits ensuring employees are paid correctly. When you go for a bookkeeping firm, you get some additional assurances not provided by solo bookkeepers.

Disadvantages of Working With An Outsourced Controller

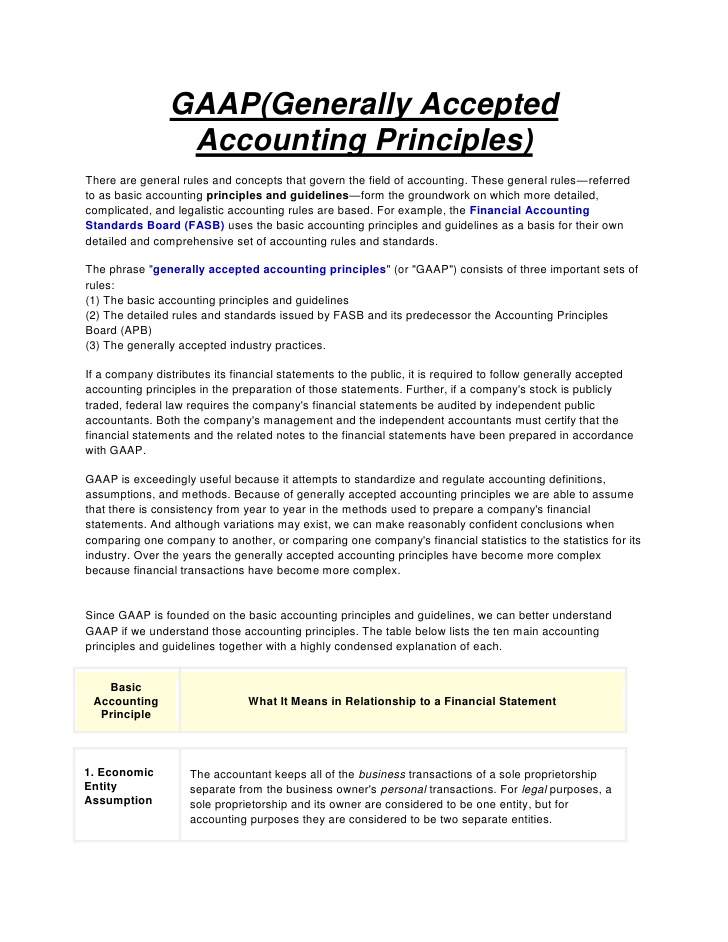

Before we jump into the intricacies of outsourcing, let’s quickly revisit the basics of bookkeeping. Bookkeeping is the process of recording, storing, and retrieving financial transactions for a company. This includes everything from purchases, sales, and payments to receipts.

It grants access to specialized expertise

- At Pilot, your dedicated account manager is always available to support you and answer any questions.

- Offshore staffing has a bevy of benefits, not least the potential for up to 70% cost savings.

- Luckily, accounting and bookkeeping don’t have to be the business owner’s responsibility anymore.

- An early and open discussion about this can keep you from being hit with unexpected costs down the line.

But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. In 2024, as AI technology advances, data https://www.online-accounting.net/ security becomes a critical priority for businesses using cloud-based outsourced bookkeeping and accounting services. With AI increasingly targeted by cyber-attacks, companies must prepare for potential breaches. Gartner projects a 14% rise in data security and risk management spending this year.

Improved Financial Reporting

It offers flexibility, expertise, and can be a cost-effective solution. However, it’s crucial to find the right partner and maintain open communication to ensure success. For streamlined financial management, you can trust our outsourced bookkeeping services in the US. We offer efficient online bookkeeping solutions aligned with your business needs. With extensive expertise in outsourced bookkeeping, our team ensures accurate and reliable financial reporting, which can save you time and resources. Bookkeeping outsourcing is a strategic move that allows organizations to streamline their financial management procedures, save expenses, and increase accuracy.

Although technology has streamlined the process somewhat, bookkeeping remains a challenge for many business owners. In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business. They’ll track KPIs that are important to you, provide regular financial reporting, and be responsive to your needs when you call with questions. Yes, outsourcing accounting can offer substantial cost savings compared to in-house solutions, even when evaluating similarly skilled providers.

But Merritt Bookkeeping’s most stand-out feature might be its in-depth financial reports. Most other virtual bookkeeping services give you basic financial reports only, like income statements and balance sheets. In contrast, Merritt gives you more detailed reports like forecasting and quarterly https://www.personal-accounting.org/luca-pacioli/ comparisons. Selecting an accounting service provider is a critical decision that can significantly impact the financial health of your business. So, find a firm with experience and expertise in your industry, check their credentials, and review testimonials from past clients.

Experienced bookkeepers are often better at finding overdue clients and cuts your company could make to increase overall profit. Plus, having an outsourced bookkeeper is more cost-efficient in the first place, since you’re not technically their employer. Bookkeepers use an accounting journal or an online accounting program to keep track of each transaction and the purpose of the transaction. Bookkeepers also handle payroll and payroll taxes, send invoices, handle accounts payable and keep track of overdue accounts. Without a great bookkeeper, your company could be losing thousands of dollars each period. Businesses hire outside bookkeepers and pay them depending on the size of the business and how long they need help.

Virtual bookkeeping connects you with real bookkeepers via a secure, online account. A top-notch service will download your expenses automatically through online banking and through your merchant processor, so you don’t have to send envelopes of receipts. Beyond day-to-day operations, having your bookkeeping taken care of by a professional expedites the tax filing process.

When looking for outsourced accounting services, businesses have many price options. Affordable plans start at under $100 per month, perfect for small businesses or startups that need basic bookkeeping and financial reporting. Once the system is up and running, it’s essential to allow the new bookkeeper to do their job. Don’t worry about financial reporting, payroll taxes, accounting tasks, or offline vs. online bookkeeping. You have made your choice, and now it’s time to enjoy having a dedicated account manager and bookkeeper do the job for you. When it’s time to pay taxes, an online bookkeeping service can offer you a year-end financial package.